Accounting Blog

Everything you need to know about accounting and how we can help you out will be located here.

With a team of fully qualified experts, we deliver high-level tax advice and solutions tailored to your business needs.

Leading accounting blog in the UK

August 25, 2025

August 25, 2025

How to Calculate Your Carbon Footprint in 2025: A Practical 4-Step Guide for Businesses

Calculating your company’s carbon footprint is the process of measuring all greenhouse gas emissions from your business activities.

Continue reading August 19, 2025

August 19, 2025

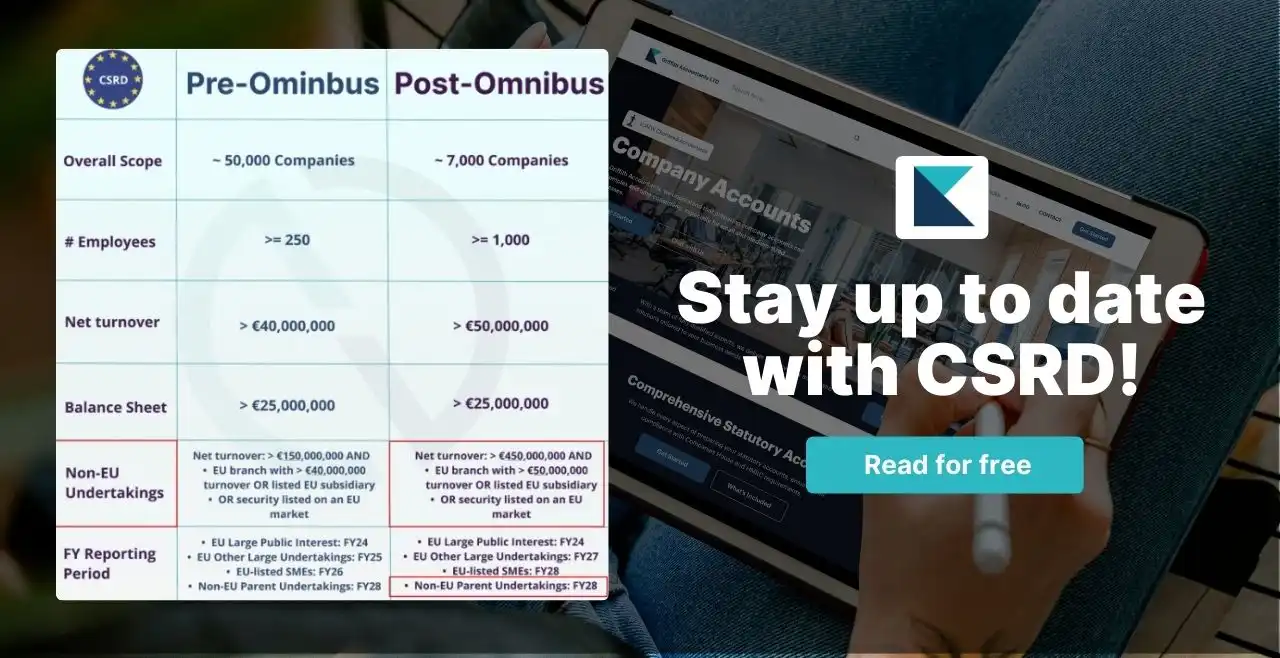

Sustainability Reporting in the UK & EU: What Small Businesses Need to Know

Learn how the EU CSRD and UK sustainability reporting rules affect small businesses, and how to prepare for future reporting requirements.

Continue reading July 12, 2025

July 12, 2025

Sustainability Finance in the UK & EU: Why It’s Critical for Business Growth

As sustainability finance climbs the corporate agenda, businesses across the UK and EU are under increasing pressure to align with environmental and social goals. But this shift isn’t just about compliance it’s about opportunity.

Continue reading March 25, 2025

March 25, 2025

Accountant for Uber Drivers

If you’re an Uber driver in the UK, you might be wondering: do Uber drivers need an accountant? The short answer is no, you are not legally required to hire an accountant. But let’s dig a little deeper into why having one could make a big difference in your driving gig.

Continue reading March 25, 2025

March 25, 2025

Company Accounts Bookkeeping Importance

Whether you’re a small business owner or running a larger enterprise, keeping accurate company accounts is vital for legal compliance, financial decision-making, and overall business success.

Continue reading March 25, 2025

March 25, 2025

Financial Statements in the UK

Every company, whether it’s a start-up or a well-established enterprise, relies on four essential financial statements to monitor its financial health and overall company accounts.

Continue reading“Thank God I moved to you, my previous accountants were not professional”

Michael Wilkinson

Read reviewsNeed more help?

Our accounting blog can provide a lot of information but some scenarios might be a bit more tricky so feel free to reach write to us directly to go over your accounting needs.

Ready to start?

Get StartedUp-to-date insights on UK tax legislation.

Personalised tax strategies for your business.

Ensuring compliance while optimising tax savings.

General FAQs

1. What types of businesses do you work with?

We support a wide range of businesses, from startups and sole traders to SMEs and larger corporations, across various industries in the UK.

2. What services do you offer?

In addition to traditional accounting, we provide Corporation Tax Services, Sustainability Strategy & Compliance, bookkeeping, payroll, VAT returns, and business advisory services.

3. How can you help my business stay tax-compliant?

We ensure your business meets all UK tax obligations by handling tax returns, offering tax planning strategies, and keeping you updated on regulatory changes.

4. Do you offer sustainability accounting and compliance services?

Yes, we help businesses align their financial strategies with sustainability goals, ensuring compliance with ESG (Environmental, Social, and Governance) regulations and reporting standards.

5. How do I get started with your services?

You can contact us via our website or phone to schedule a consultation. We’ll discuss your needs and tailor our services to support your business effectively.

While we aim to cover all questions in our FAQ, obviously it’s impossible therefore for ease of knowledge, we would advise you to book a meeting with us.

Looking for a more laid-back approach?

Accounting Done For You

Everything you need to know regarding your company accounts will be covered in our preliminary discussion with your or your team.