Sustainability Reporting in the UK & EU: What Small Businesses Need to Know

Sustainability reporting is no longer just for big businesses. New regulations in the EU and emerging UK standards mean more businesses will soon need to track and share their environmental, social, and governance (ESG) impact.

If you are a UK small business owner, you might be asking: Do I need to comply with the EU’s CSRD? What are the UK sustainability reporting rules? And how should I prepare? Let’s break it down in plain English.

What Is the CSRD? (Corporate Sustainability Reporting Directive)

The Corporate Sustainability Reporting Directive (CSRD) is an EU law that came into effect in January 2024. It replaces the old Non-Financial Reporting Directive and sets stricter, standardised requirements for sustainability disclosures.

Under the CSRD, companies must report on:

- Environmental factors: carbon emissions, energy use, waste, water

- Social factors: employee welfare, diversity, community impact

- Governance: ethical conduct, anti-corruption measures, supply chain oversight

Reports must follow the European Sustainability Reporting Standards (ESRS), so data is consistent and comparable across industries.

Does the CSRD Apply to UK Businesses?

Yes, in some cases. Even though the UK is outside the EU, the CSRD can apply to UK companies if they:

- Have a net EU turnover over €450 million (as per Omnibus updates) and Operate through a large or listed EU subsidiary or branch

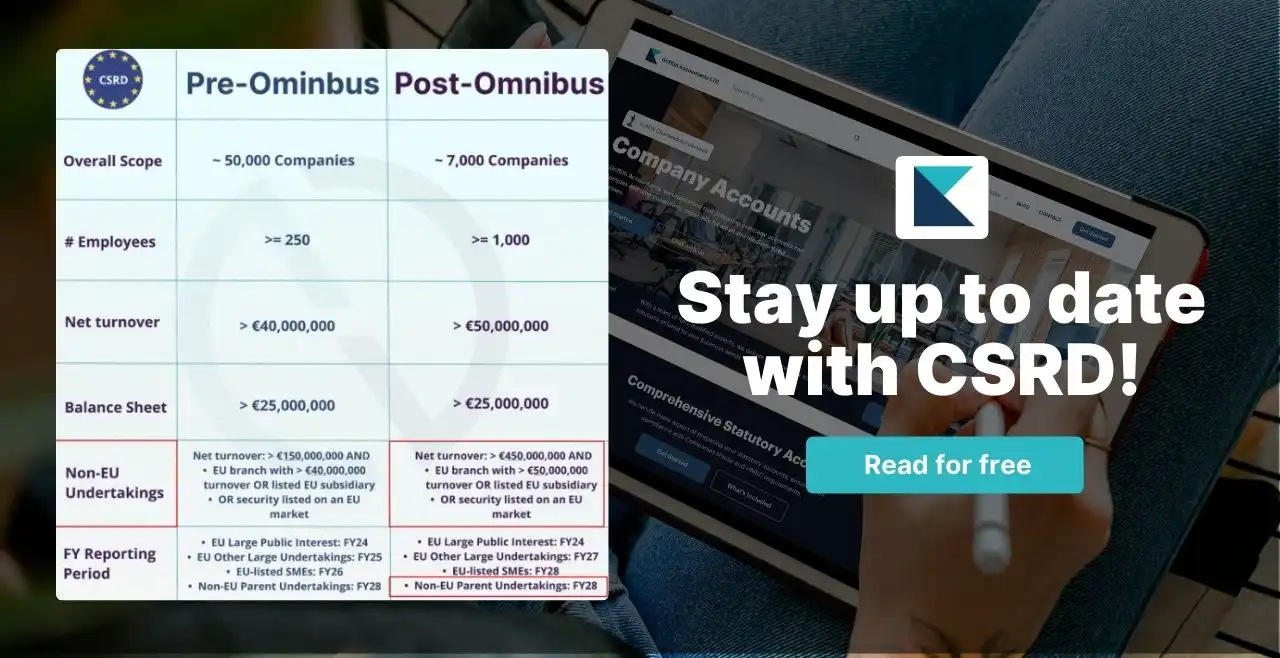

Look at the table below for more information.

Most UK small businesses will not be directly in scope. However, if you supply goods or services to companies that are subject to the CSRD, you may be asked for your sustainability data as part of their compliance process.

UK Sustainability Reporting Rules

The UK currently has no exact equivalent to the CSRD, but sustainability reporting is already required for:

- Large UK companies (over 500 employees) and certain LLPs climate-related financial disclosures are mandatory

- Listed companies must report in line with the UK’s TCFD-aligned framework (Task Force on Climate-related Financial Disclosures)

The UK government is developing Sustainability Disclosure Standards (SDS), expected to align closely with the IFRS Sustainability Standards. This means UK rules could expand to cover more companies in the future.

We can take care of this for you

Why Sustainability Reporting Matters for Small Businesses

Even without a legal requirement, small businesses can benefit from sustainability reporting:

- Win contracts – Many large customers prefer suppliers with clear ESG credentials

- Save money – Tracking energy and resources often uncovers cost savings

- Enhance reputation – Customers value transparency and responsibility

If you work in a supply chain, proactive reporting can also make you a more attractive partner.

How Small Businesses Can Prepare Now

You don’t need to wait for the law to change. Start building your sustainability profile with these steps:

- Track key metrics – Energy use, travel, and waste generation

- Set measurable goals – Aim for annual improvements

- Create simple policies – Document your environmental and social commitments

- Keep accurate records – Store data so it’s ready for clients or auditors

Conclusion

For most UK small businesses, sustainability reporting is not mandatory yet but the trend is clear: more transparency, more data, more accountability. Preparing now will give you a competitive advantage when working with bigger clients or when new rules arrive.

At Griffith Accountants, we help small businesses integrate sustainability into their business strategy.